Delete your bank: why banking apps will soon become redundant

In 2022, there will be one app that everyone uses to manage their finances. And it won’t have been created by a bank. So who did create it? Step into my DeLorean and join me as we go back to the future.

Will Google, Amazon, Facebook or Apple soon dominate the financial market? Could be. But let's assume for this story that it’s PayPal. How did PayPal manage to create the standard banking app for consumers? I’m writing this blog post in 2022, and here is my reconstruction:

September 2019

The new Payment Services Directive (PSD2) has finally come into effect in the European Union and all banks have been required to make their programming interfaces (APIs) available for general use.

PayPal has been working behind the scenes on one comprehensive app that can immediately make use of that information. To use this PayPal app you don't have to change your bank account. On the contrary: the core of the application is that you can accommodate all the financial service providers you do business with. So instead of having to download and update five different apps, you can take care of all your banking with one single mobile solution.

PayPal has a head start, because 2 million Dutch people already have a PayPal account. From one day to the next, all these people have a personal finance manager (PFM) in their pockets.

So what can the app do, exactly? In a nutshell:

- View all account and credit card statements for any European bank;

- Use Google Pay and Apple Pay, which have been integrated into the app;

- Categorise expenditure such as fixed costs, groceries, entertainment, etc;

- Create separate virtual funds for groceries, rent, a financial buffer, etc., helping users to manage their budget;

- See what is ‘left to spend' - the user’s balance minus what still needs to be paid that month and what expenses they have budgeted for;

- Set rules for money movements ('if this, then that'). “When my salary comes in, 10 percent should be transferred to my savings account.”

2020

PayPal has been integrated into WhatsApp and has made payment apps such as the Dutch Tikkie redundant in one go. Transferring money is now as easy as sending a picture - no need to leave WhatsApp. Banks are seeing a decline in the use of their apps. There are fewer logins and fewer transfers. PayPal is slowly taking over their market share.

The real strength of the PayPal app is that the platform has been opened to third parties. Insurance companies, phone companies, budgeting advice foundations and others can make plugins for the app. Clients can now get a better deal on their car insurance, or change their Netflix subscription, all within the app. The app even allows for clients to handle their insurance claims.

Clever developers create even more useful tools, such as the ability to scan photos taken with the phone’s camera and extract receipts from the image. These receipts are then linked to the transaction based on location and time, and automatically appear in the financial statement.

2022

The banks can no longer ignore PayPal. They join the platform and make it possible for clients to open an account within the PayPal app. So now people’s entire financial ecosystem is in one application. All other apps are officially redundant.

How likely is all this?

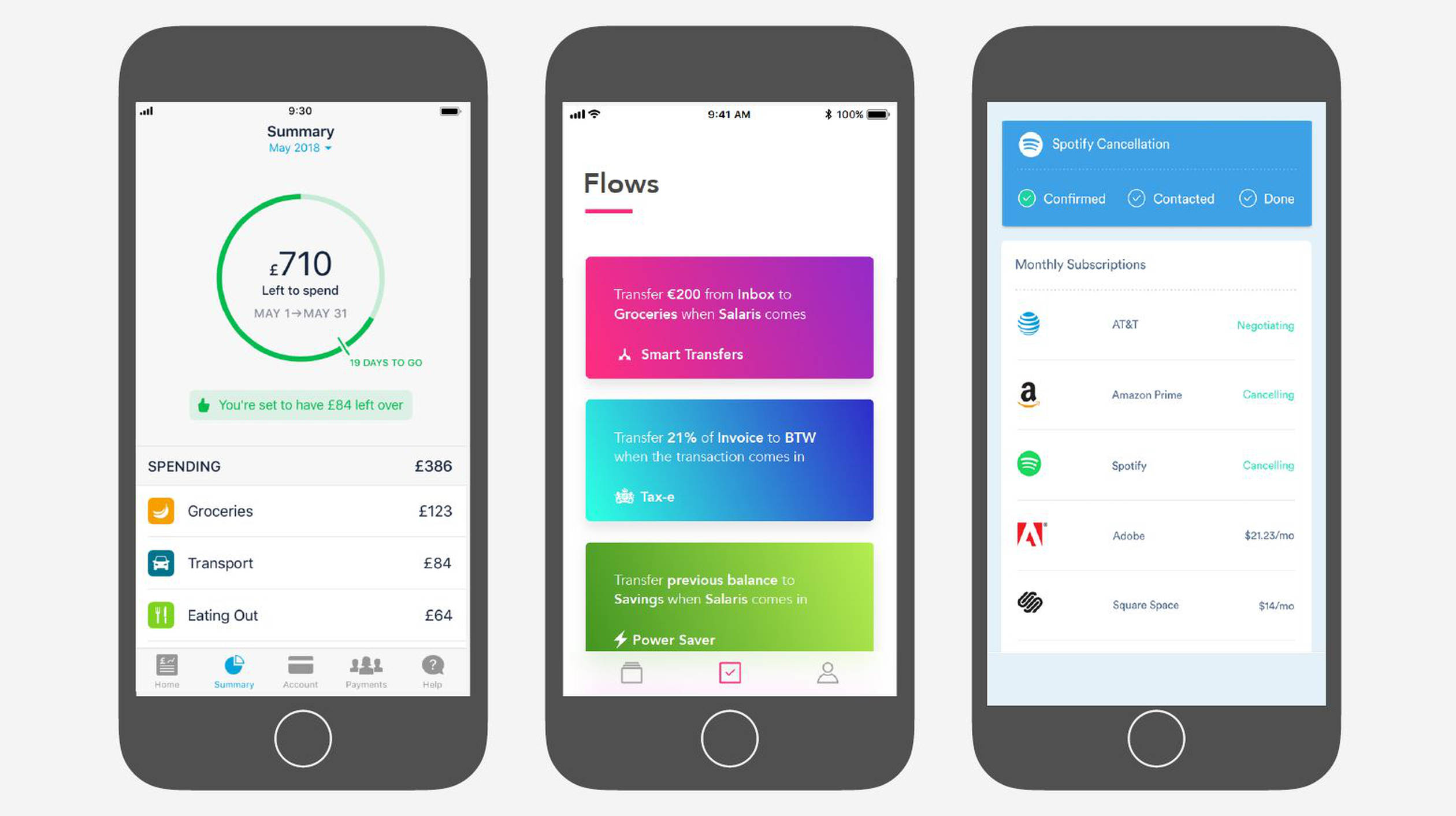

Could all of this really happen? The funny thing is: it has already happened. The future is already here, it’s just that the functionalities I mentioned above have not yet been integrated in one place. Just look at what these existing apps offer:

- Yolt, United Kingdom: places accounts from different banks in one overview, monitors accounts and subscriptions, compares energy suppliers, etc;

- Bankin, France: automatically categorises transactions from all your accounts, including PayPal;

- Simple, United States: allows clients to create digital envelopes where they can put money for a certain purpose;

- Monzo, United Kingdom: 'left to spend' - your spendable balance instead of your 'real' balance;

- Flow Your Money, the Netherlands: automates transactions based on rules and triggers. Is built on Bunq, the only bank that has made APIs available so far;

- WhatsApp Payments, India: based on the Indian variant of PSD2, WhatsApp is testing a beta version that allows users to send money within a chat, just like a picture;

- Clarity Money, United States: shows in one overview how much users spend on subscriptions and enables users to cancel their Netflix or fitness subscription from the app;

- Fintonic, Spain: incorporates all bank accounts, insurance and loans in one app, which also handles claims;

- Numbrs, Germany: allows users to take out banking products and insurance in one app.

Three possible outcomes: now’s your chance

The PayPal example is fictitious. I have no indication whatsoever that this company is working on an app like this. But whichever company picks up the ball, the universal financial app I described above is sure to come. What does this mean for financial service providers? I see three possible options:

- You decide to compete and create the best app, packed with useful features as described above;

- You keep your own app but also make sure you can provide services to that one killer platform, whichever one it turns out to be;

- You stop using your own app and integrate your services into the third party app.

Whichever option you choose, it will only be a small part of what you do, what your company stands for and how you help your customers. Those are the things that really offer a great opportunity. One that is not really being used by any player at the moment. People tend to manage their finances badly. Almost half the population is concerned about their financial future, but at the same time, more than half is not setting aside any money for retirement. A third of this group simply does not have the financial room to do so, and the others are just not that concerned with what might happen in the future.

Because everything has become digital, we no longer know where our money is going. The information is fragmented - it's in emails, banking apps or user accounts. The result is that a lot of expenditure takes place unconsciously and a lot of money just leaks away. Money that could also be deposited in a pension fund. This is precisely the kind of thing financial institutions could help people with.

From fast money to slow money

What you see now, however, is that innovation is focused on 'fast money', such as features that make it easier to transfer money. Slow money is about pensions and saving for later. People are not naturally interested in this and you see few innovations. My advice: seek out the middle ground. Research how fast money interactions can better serve slow money.

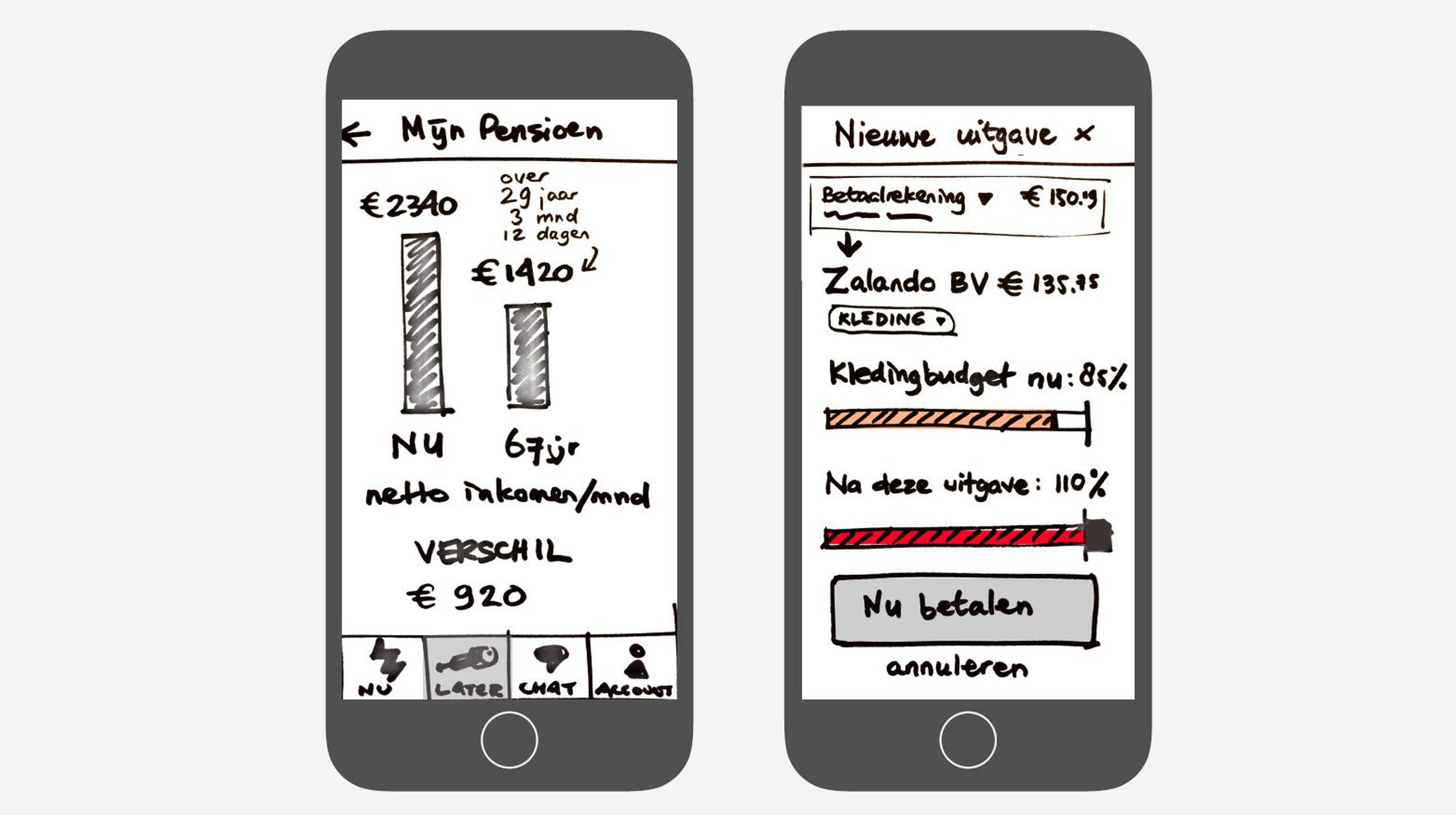

An example: if a Dutch person wants an overview of their pension situation, they need to go to a separate website and log in with a specific code. In many other countries, a person wanting to know the facts would have to write an email or a letter. That threshold is too high, especially considering people are not very interested in this information anyway. But if the banking app that is already in their pockets would give a handy overview of their financial future under the tab 'later', then that hurdle would be gone. Especially when practical suggestions are given for how to close a possible pension gap.

Suppose I do some shopping at Zalando.com but I have already spent 80 percent of my clothing budget. If I make this purchase, I'll go over it. The app gives me the choice: order these things now, or put the money in my pension fund. People generally don’t save money for later when left to their own devices, but these kinds of interventions can lead to more reserves. By relating fast money to slow money, you can achieve more.

Join the ratrace? Or try a different approach?

Those wanting to take this opportunity must first stop taking part in the feature rat race. There is no reason to build another payment app like Tikkie. In a couple of years Tikkie, a payment app which is used in the Netherlands and Germany, will be outdated and you will have invested a lot of time and money trying to match an unnecessary application. Apple already handles payment requests within iMessages in the US and does so much more efficiently than Tikkie. That's not surprising, because large technology companies can develop features for fast money much faster than any bank. The question is whether you should want to compete.

A better approach would be to work thematically, by looking at user problems and needs and not necessarily at building features. The success of a feature that makes payment requests or allows users to define savings goals, for example, is determined by quantity: how many downloads there have been, how many users there are, how many accounts have been created, how much money has been mediated. These are beautiful metrics but they don’t necessarily tell us if a feature made a user’s life any better.

By thinking in themes you can arrive at the same feature but you will be moving on a higher level. What is the underlying reason for a payment request? Perhaps users want to share common costs. Why is someone saving? Maybe he or she is trying to find the balance between now and later. The focus of this approach is on the users and the success is determined by the effect: do they have less stress and more financial autonomy and self-confidence? And the ultimate test: do we see that people have more money saved for later?

One final piece of advice: get out from behind your desk. Find your end users. Quantitative research can tell you that something is happening, but not why. You can only find that out by visiting your customers at home and seeing how they manage their money. Go talk to people, apply methods like diary studies and experience sampling. That is the most important thing if you don't want to participate in the feature rat-race but do want to add value for your users. As Doc Brown told Marty McFly at the end of the Back to the Future trilogy: Your future hasn't been written yet. No one's has. Your future is whatever you make it. So make it a good one!